![]() Views: 194

Views: 194

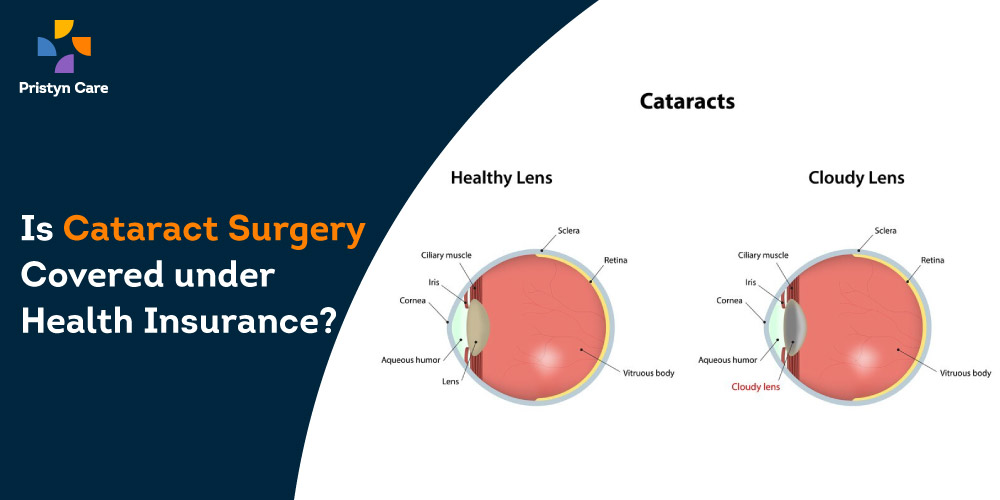

Is Cataract Surgery Covered under Health Insurance in India?

Dedicated Support at Every Step!

Our Doctors are available 24 hours a day, 7 days a week to help you!

More than 65 lacs cataract surgeries are performed in India annually. While some people use insurance to pay for the treatment, others have to pay for the surgery from their own pockets.

If you have to pay for cataract surgery personally, you should know that it is generally covered under health insurance policies offered by various providers. The average cost of cataract surgery ranges from Rs. 25,000 to Rs. 35,000 per eye. So, if you have to undergo surgery for both eyes, the overall cost will be around Rs. 50,000 to Rs. 70,000. It is a huge sum of money that not every person can afford.

The good news is that most health insurance companies in India offer ample coverage for cataract treatment at affordable premiums. But there are some rules and regulations to use that policy as well. So, today, we are going to explore all aspects of health insurance policies that can be used to cover the cost of cataract surgery.

Table of Contents

Are all types of cataract surgery covered under insurance?

Yes. Cataract surgery is medically required to restore the vision and to protect the patient from partial or complete blindness. Hence, all procedures are included in the coverage.

The surgery is recommended by the surgeon after an accurate diagnosis. And as the cost of different procedures is also different, the entire cost of treatment may or may not be covered under your policy.

For instance, phacoemulsification cataract surgery costs around Rs. 40,000 per eye, extracapsular cataract surgery costs around Rs. 40,000 to Rs. 60,000 per eye, and bladeless cataract surgery costs around Rs. 85,000 to Rs. 1,20,000.

*Note- Bladeless procedures involves MICS (micro-incision cataract surgery) and FLACS (Femtosecond laser-assisted cataract surgery)

As you can see, the bladeless procedures are the most expensive ones. The cost of cataract treatment further increases if the patient decides to get premium intraocular lenses. And one thing you should know is that the cost of premium cataract lenses is usually not covered under insurance policies.

Also read : How Much Can I Claim for Cataract Surgery?

Typically, a person has to wait for at least 2 years before their health insurance policy provides coverage for cataract treatment. It means that if you buy a health insurance plan today, you’ll have to pay the premiums and wait for at least 2 years from the date of purchase to avail of the policy to undergo cataract surgery.

This clause is included in the policy terms to ensure that the policyholders don’t purchase a plan solely to cover the expenses of a cataract operation.

So, if you buy a health insurance policy in your younger years, you can claim the cataract coverage later in life whenever required.

No Cost EMI, Hassle-free Insurance Approval

Things You Should Know About Insurance Coverage

Like the clause mentioned above, there are other rules and regulations too that a policyholder should adhere to. We are including the major things that you should know about the coverage before you file for a claim.

- Limit on the Claim Amount

There is a standard limit on the amount that can be claimed as reimbursement for cataract surgery under health insurance coverage. However, any additional expense that incurs during the treatment over the sub-specific limit must be paid by the individual on their own.

The limit on the claim amount also varies from one insurance provider to another. There are even some insurance providers who provide the full expense of the cataract surgery in the claim amount.

But you should always keep in mind that you may not get the full sum insured amount for your cataract surgery from all insurers. The best thing would be choosing a provider that offers full coverage for cataract treatment without any sub-specific limit.

- Extent of Coverage

While you are purchasing a health insurance policy, confirm whether the coverage will be enough for both eyes or not.

A person who has a cataract in one eye is more likely to eventually get a cataract in the second eye. Thus, it is important that your policy has ample coverage in case you need it. Get the extent of coverage that will be enough to pay for the treatment and also check if you can get other provisions as well.

- No Coverage for Pre-&-Post-Surgery Care

Currently, the policies that are generally offered by the insurance providers don’t cover the cost of additional expenses such as eyeglasses, eye drops, medications, etc. which may be needed before or after the surgery. You will have to bear such expenses on your own.

MBBS, Diploma in Radio Diagnosis & MD-TB & Respiratory Diseases

FREEConsultation Fee

Common Insurance Plans In India for Cataract Coverage

Here we are listing some popular health insurance plans from reputed and reliable insurance providers that offer cataract treatment coverage. For more information, you can contact us at +919311583422.

| Insurance Company | Plan Name | Waiting Period | Claim Limit |

| ICICI Lombard | Complete Health Insurance | 2 years | Up to Rs. 20,000 per eye |

| Care Health Insurance | Care Care Freedom (Senior Citizens) | 2 years | No sub-limit |

| Star Health Insurance | Senior Citizens Red Carpet Policy | 2 years | Up to Rs. 25,000 |

| Oriental Insurance | Happy Family Floater | 2 years | No sub-limit |

| SBI General | Health Insurance | 2 years | Up to 15% of the sum insured (Rs. 25,000 per eye) |

| Apollo Munich Health Insurance | Optima Senior | 2 years | No sub-limit |

| Bajaj Allianz | Health Guard | 2 years | Up to 10% of the sum insured (Rs. 35,000 maximum) |

Also read: What Should You Expect From Cataract Surgery?

The Bottom Line

The eyes enable you to see the world and appreciate its beauty. Losing your vision would be one of the worst things that could happen to you. People who leave cataracts untreated or the ones who cannot get treatment for cataracts due to financial issues have to suffer from unwanted consequences.

To make sure that people suffering from cataracts can get proper treatment without worrying about finances, the Indian Government is encouraging people to get insurance policies. You can choose any policy that suits your needs and seek the best-in-class treatment for cataracts.

But at Pristyn Care, we have another solution for you. Along with accepting all major insurance policies for cataract treatment, we also offer a No-Cost EMI option to the patients. It helps them to get treatment in the present day and pay for it later in easy installments.

Pristyn Care is dedicated to making all kinds of surgical treatments more accessible for everyone who needs them. Get in touch with us and let us help to remove all the hurdles from your path to get optimal medical care for cataract treatment.