Bariatric surgery is a term you might have heard from your doctor or a friend who is trying to lose weight. It's a Read More...

Allurion Gastric Balloon Treatment

23 days agoIntroduction

Are you overweight? Fed up with spending all your money on diet planning, exercises, and other practi Read More...

How Weight Loss Works?

23 days agoIntroduction

Weight loss is currently among the top priorities for several people. After all, most of us fail to Read More...

PC Assist

How To Break A Weight Loss Plateau?

Introduction Let’s face it- losing weight is no cakewalk, and each day in the journey can feel like nothing sh Read More...

Is It Possible To Lose 12 Kg in a Month?

23 days agoIntroduction When it comes to weight loss, most people are in a hurry to lose the maximum weight in the shorte Read More...

Obesity is a complicated disease that involves stubborn fat in the human body. It leads to many health concerns and Read More...

Are Weight Loss Surgeries Safe?

23 days agoObesity is a complex disease that involves too much body mass. A BMI (Body Mass Index) of 30 or higher is the stand Read More...

Treatment Of Varicocele Without Surgery

23 days agoVaricocele is a common vascular problem that many men face at a certain point in their lives. It is the condition o Read More...

Does Age Play A Role In Male Fertility Level?

23 days agoThere are various factors that affect male fertility and one of them is aging. Yes, age does play a crucial role in Read More...

Lifestyle today makes us do so much that we do not want to spend time on ourselves. We tend to ignore minor pain, b Read More...

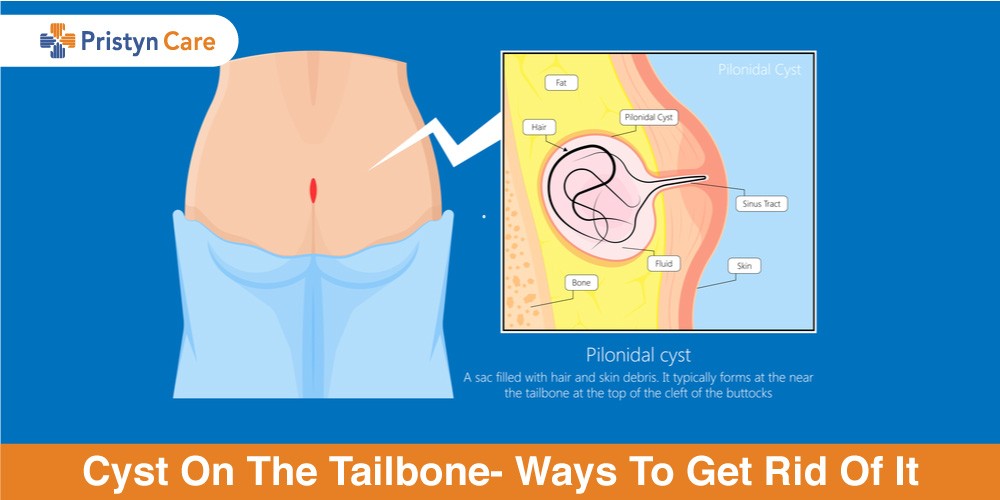

Cyst On The Tailbone- Ways To Get Rid Of It

23 days agoThe condition of cyst on the tailbone is called a pilonidal cyst. Such a cyst arises on the tailbone due to factors Read More...

We often tend to find natural or home remedies to get rid of the problems that we suffer from. Nothing beats natura Read More...